Editor’s Note

This article has been updated in 2025 for better comprehension, user experience, and relevancy.

It’s difficult to miss that more and more disruptors, such as e-wallets and QR Pay services, are emerging in the digital payment industry worldwide, including Malaysia.

All the signs are pointing towards our gradual transition to a cashless society where banknotes and coins become increasingly obsolete in the future, but right now, cashless is still largely optional in Malaysia.

At today’s e-outlets, consumers have a few payment methods to choose from — online banking, credit/debit cards, over the counter (OTC), eWallet, and Buy Now, Pay Later (BNPL). Before we get into the most preferred payment gateways, let’s identify each of these widely used payment methods:

Online banking/FPX

FPX is a convenient and secure online payment solution that allows instant debiting of a customer’s internet banking account. Transactions are processed immediately upon simple authentication and confirmed with payment notifications and receipts. It’s reliable, secure, convenient, and easy to use.

Credit Card

Credit and debit cards are still one of the most common payment methods worldwide. Some of the most popular cards used in Malaysia are Visa, Mastercard, Union Pay, and AMEX.

eWallet

eWallets work essentially through the use of a prepaid credit account. They are quite literally electronic wallets that users have to reload or top up. Some popular eWallets in Malaysia are Boost, Touch n Go, GrabPay, and Alipay.

Over-the-Counter (OTC)

Businesses that target customers in more rural areas would make this option available to allow online purchases to be completed with offline payment.

Buy Now, Pay Later (BNPL)

A relatively new player in the online payment scene, BNPL is a short-term financial option that offers customers an installment-like payment plan for instant purchases. Some examples include Atome, Grab Pay Later, and Shopee Pay Later.

Now, the real question is, who handles these online payment methods? How can business owners access a one-stop solution that covers a variety of payment methods, offering their customers choices when making payments?

The answer: Payment gateways

Payment gateways are trusted third-party channels that process your customers’ cashless payments regardless of the method. They are secure, quick, and efficient.

However, bear in mind, using these payment gateways requires transaction fees from your customers. Each provider varies, so it’s best to do your research before you decide which suits your business needs.

To help you out a little, let’s meet the 5 most popular online payment gateways in Malaysia.

iPay88

iPay88 is a leading regional Payment Gateway Provider in Southeast Asia, providing solutions for one-click payments. They accept and process all major credit cards, debit cards, and e-money, and merchants can easily transfer their funds to local bank accounts.

As of now, iPay88 processes up to 26 currencies, and has over 30 payment methods available, including all of the aforementioned — FPX, credit/debit card, eWallet, and OTC payment.

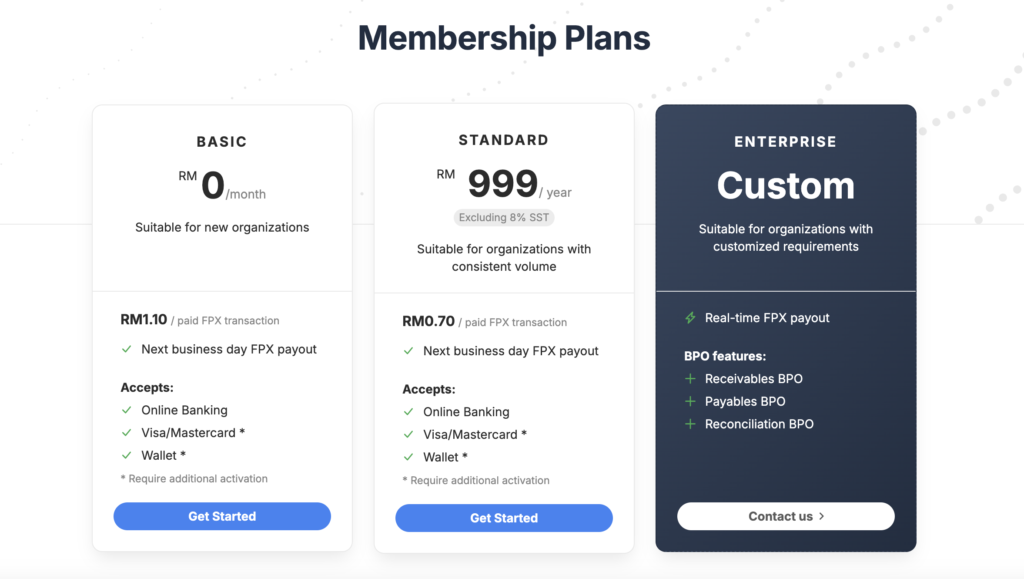

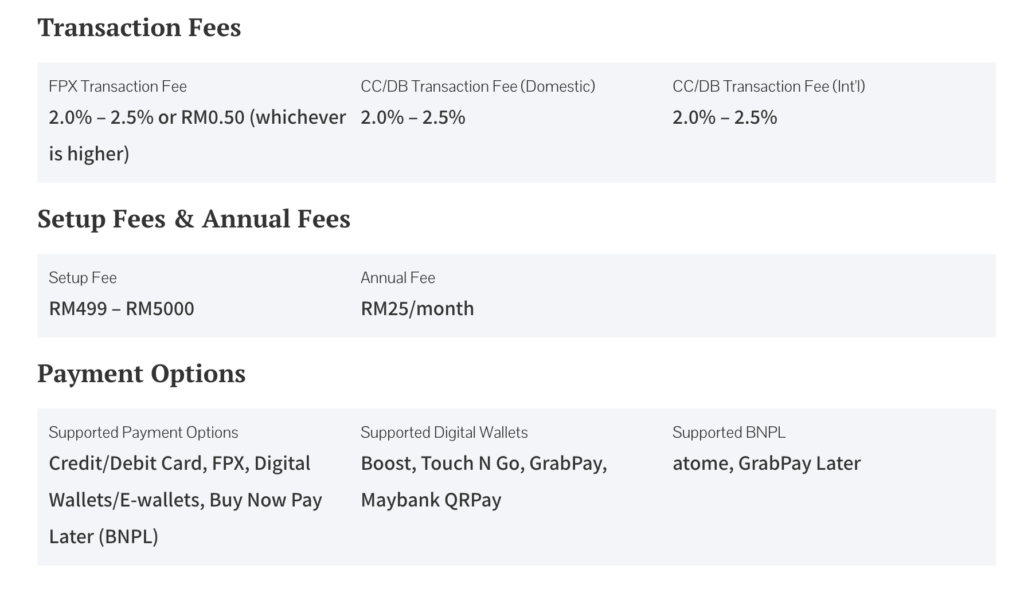

Billplz

A Malaysian-made payment solution, Billplz is preferred for its affordability and simplicity. Targeted at SMEs and freelancers, it is one of the more budget-friendly options on this list due to its low transaction fees (1.5%—2%) and promise of no hidden charges.

With one-click integrations for platforms like Shopify and WooCommerce, businesses can start accepting FPX payouts without complex setups or lengthy approvals.

eGHL

eGHL is known for providing a frictionless and seamless payment ecosystem that meets the rapidly evolving needs of today’s businesses. It offers business owners real-time data and insights to help them make informed decisions.

With over 100+ payment methods via one single connection point, they are easily one of Malaysia’s most popular payment gateways.

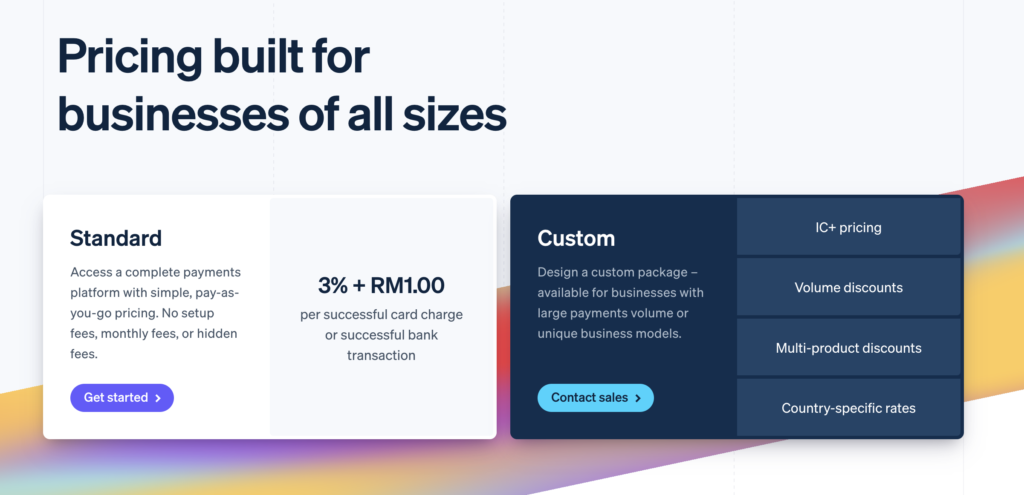

Stripe

Stripe is a full-stack payments processor that’s easy-to-use API allows it to connect with just about any e-commerce platform and enable business owners to accept payments, send payouts, and manage their businesses online.

It’s worth noting that Stripe focuses on building pricing options for all sizes of businesses. You can even build a custom plan that suits your business needs. As of now, they support up to 135+ currencies, which allows for a bigger international customer base.

Fiuu

Previously known as Razer Merchant Services (RMS), Fiuu offers payment options for businesses needing online and in-person transactions, gaming platforms, and digital content sellers.

What sets Fiuu apart? It’s built to easily handle high-traffic transactions, ensuring reliability even at scale. With one of the lowest dispute transaction ratios in the industry, it’s a trusted solution for businesses that can’t afford system downtime.

Next Step for You

With countless options for online transactions, choosing the right payment methods for your website or app can be a blur, but that’s what we’re here for.

From building responsive websites and mobile apps to setting up payment integrations, Snappymob has helped many businesses jump-start their online operations. Feel free to talk to us about your goals!